Click here to read the full article.

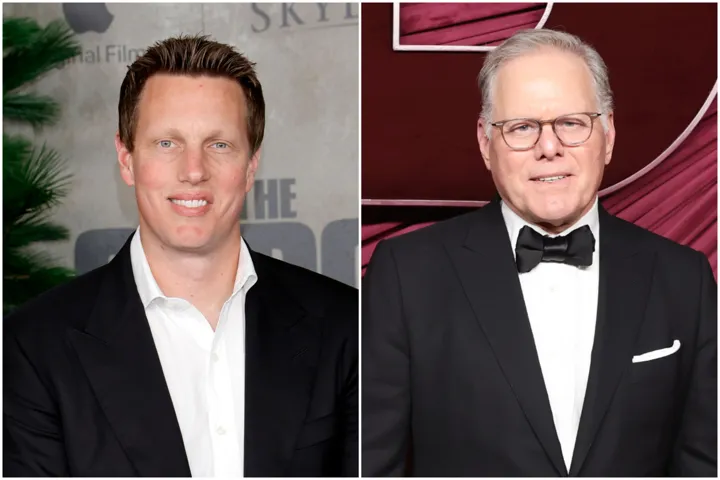

David Ellison is not going away quietly in his quest to land Warner Bros. Discovery.

On Monday, Ellison’s Paramount Skydance announced it has commenced an all-cash tender offer to acquire all of the outstanding shares of WBD for $30 per share — the same terms it offered in a Dec. 4 bid submitted to the Warner Bros. Discovery’s board. Paramount’s proposed transaction is for the entirety of Warner Bros. Discovery, including the TV business with CNN, TBS, TNT and other networks.

Paramount’s announcement, taking its bid directly to WBD shareholders, comes after Netflix and Warner Bros. Discovery revealed their binding agreement Friday under which Netflix would buy Warner Bros.’s studio operations, HBO and HBO Max for $72 billion (with an enterprise value of $82.7 billion).

According to Paramount, its all-cash offer equates to an enterprise value of $108.4 billion (including assumption of debt) with an equity value of $77.9 billion. In contrast, the Netflix proposal entails “a volatile and complex structure” valued at $27.75/share in a mix of cash ($23.25) and stock ($4.50), subject to collar and the future performance of Netflix, equating to an enterprise value of $82.7 billion (excluding the TV biz), per Paramount.

Paramount said its deal offer for WBD would close within 12 months, compared with Netflix’s projected 12-18 months for completing its deal. WBD is required by law to inform shareholders within 10 business days whether it will accept or reject Paramount Skydance’s $30/share offer. Paramount’s tender offer, which was approved unanimously by its board, is scheduled to expire at 5 p.m. ET on Jan. 8, 2026, unless the offer is extended.

“Our proposal is superior to Netflix in every dimension,” Paramount Skydance CEO David Ellison said on a call Monday morning with analysts and investors.

“Paramount’s strategically and financially compelling offer to WBD shareholders provides a superior alternative to the Netflix transaction, which offers inferior and uncertain value and exposes WBD shareholders to a protracted multi-jurisdictional regulatory clearance process with an uncertain outcome along with a complex and volatile mix of equity and cash,” Paramount said in announcing the hostile takeover maneuver.

Paramount’s $30/share offer is backed by $40.7 billion in capital from Oracle co-founder Larry Ellison, David Ellison’s father, and RedBird Capital Partners — both of which put in the money for Skydance Media’s $8 billion acquisition of Paramount Global — and funding from the sovereign wealth funds of Saudi Arabia, Qatar and Abu Dhabi as well as Affinity Partners, the investment company formed by Jared Kushner, who is Donald Trump’s son-in-law, according to an SEC filing by the company.

Paramount’s offer for WBD as of Dec. 1 included an aggregate $24 billion in financing from the Middle Eastern funds. Variety had previously reported the the three funds were part of the latest bid. Paramount also said its WBD bid will be financed in part by $54 billion in debt commitments from Bank of America, Citi and Apollo Global Management.

According to Paramount’s deal terms to acquire WBD, the three Middle Eastern sovereign wealth funds (Saudi Arabia, Qatar and Abu Dhabi) and Kushner’s Affinity Partners “have agreed to forgo any governance rights — including board representation — associated with their non-voting equity investments.” As such. according to Paramount, the deal “will not be within CFIUS’s jurisdiction,” a reference the Committee on Foreign Investment in the United States, which is the U.S. government’s interagency body that reviews foreign investments in U.S. businesses potential national security risks. In addition, Chinese internet company Tencent, which had previously committed $1 billion to the deal, is no longer a financing partner in the $30/share offer.

David Ellison previously submitted three bids for WBD, starting with a $19/share offer in Sept. 14, then $22/share on Sept. 30 and $23.50/share on Oct. 19, which comprised 80% cash and 20% stock. The Warner Bros. Discovery board rejected all three offers. Paramount Skydance then submitted an all-cash bid of $26.50/share on Dec. 1 followed by the $30/share on Dec. 4, but the board of WBD selected Netflix’s as the buyer for WB and HBO Max.

On the call Monday, Ellison said that Warner Bros. Discovery did not respond at all to Paramount Skydance’s Dec. 4 offer of $30/share in cash.

The Paramount offer for the entirety of WBD provides shareholders is $18 billion higher than the Netflix proposal — and Paramount alleged that the WBD board’s recommendation of the Netflix transaction over Paramount’s offer is based on “an illusory prospective valuation” of the WBD TV networks entity, to be called Discovery Global, that is “unsupported by the business fundamentals and encumbered by high levels of financial leverage assigned to the entity.” Paramount asserts that WBD’s Discovery Global entity should be valued at $1/share, whereas WBD estimates the TV company is worth $3 to $4 per share.

Reps for Warner Bros. Discovery did not immediately respond to requests for comment. Netflix declined to comment.

In his previous bids, Ellison had proposed offering WBD chief David Zaslav a co-chairman and co-CEO role in a merged Paramount Skydance-WBD; it’s not known if that’s still on the table in Paramount’s latest offer.

Ellison, chairman and CEO of Paramount, said in a statement Monday: “WBD shareholders deserve an opportunity to consider our superior all-cash offer for their shares in the entire company. Our public offer, which is on the same terms we provided to the Warner Bros. Discovery Board of Directors in private, provides superior value, and a more certain and quicker path to completion. We believe the WBD Board of Directors is pursuing an inferior proposal which exposes shareholders to a mix of cash and stock, an uncertain future trading value of the Global Networks linear cable business and a challenging regulatory approval process. We are taking our offer directly to shareholders to give them the opportunity to act in their own best interests and maximize the value of their shares.”

Paramount said WBD shareholders can find additional information about the Paramount proposal at strongerhollywood.com. Paramount claims the combined Paramount-WBD business will be able to see more than $6 billion in cost synergies, “in addition to the more than $3 billion in standalone cost efficiencies that Paramount expects to achieve in its current transformation plans.” Paramount is offering a $5 billion breakup fee if its WBD deal is accepted but is not completed because for regulatory reasons.

Compared with Netflix’s deal, Paramount claimed its proposal to buy Warner Bros. Discovery would not only be better for WBD investors but also better for Hollywood at large.

“Our focus is on expanding creative output, not dominating the sector, as Netflix envisions. Our goal is to make Hollywood stronger in a way that benefits the entire ecosystem.”

On Monday Paramount pledged to release more than 30 films in theaters if it wins WBD — a clear swipe at Netflix, which historically has displayed an antipathy to theatrical distribution. In announcing its pact with WB, Netflix said it would honor Warner Bros.’s current theatrical commitments and Sarandos pointed out that the streamer releases dozens of its films in theaters (though that is mostly to qualify for awards). But Sarandos — who earlier this year dubbed the moviegoing experience “outdated” — said that “over time, the windows will evolve to be much more consumer friendly, to be able to meet the audience where they are quicker.”

Paramount also reiterated its belief that its takeover of WBD would face an easier regulatory-approval path, calling the Netflix agreement represents an “anticompetitive combination with WBD, which would entrench its monopoly with a 43% share of global Subscription Video on Demand (SVOD) subscribers.” In addition, Paramount said, “Netflix has never undertaken large-scale acquisitions, resulting in increased execution risk which WBD shareholders would have to endure.”

Paramount+ and HBO Max combined would have approximately 200 million global subscribers, “which puts us on par with Disney,” Ellison said on the call. That’s significantly below Netflix and HBO Max together with more than 400 million, according to Ellison. “So again, we really view this as, our deal is completely pro-competitive. It’s pro-creative talent, pro-consumer, as opposed to the [Warner Bros.] combination with Netflix [which] would give them such a scale that it would be bad for Hollywood and bad for the consumer, and is anticompetitive in every way that you can fundamentally look at it,” he said.

On Dec. 3, as Paramount grew concerned that WBD was leaning toward inking a deal with Netflix, lawyers for Paramount Skydance sent a letter to Zaslav expressing “grave concerns” about the alleged unfairness of WBD sales process. The attorneys suggested the Warner Bros. Discovery board has “embarked on a myopic process with a predetermined outcome that favors a single bidder” — meaning Netflix.

The Paramount letter alleged that “It has become increasingly clear, through media reporting and otherwise, that WBD appears to have abandoned the semblance and reality of a fair transaction process, thereby abdicating its duties to stockholders, and embarked on a myopic process with a predetermined outcome that favors a single bidder.” WBD’s lawyers responded that the board has “fully and robustly complied” with its fiduciary obligations.